Hongtai tells you why the more developed countries, the less support mobile payment?

With the rapid development of my country's mobile network, the popularity of smart phones, and the development of financial payment platforms such as Alipay and WeChat, mobile payment has grown wildly in recent years, and it has aggressively and rapidly invaded my country's payment market on a large scale.

In addition to shopping malls, hotels, and online shopping, my country has officially entered the era of buying a pancake fruit on a street stall and paying with a mobile phone scan code.Mobile payment is no longer a "new thing" in the younger generation or some developed regions in China, but it has really become a popular payment method popular among the public.Compared with the developing mobile payment in developing countries in China, developed countries that have always been at the forefront in the fields of science and technology, finance, and electronics have obviously lagged behind this time. Credit cards still dominate the market. Old-fashioned payment methods.

Hongtai tells you, why are people in these developed countries so keen on mobile payment as a convenient payment method? Because in their view, the "cashless era" with full coverage of mobile payments hides the danger of many dark waves.

Transparent people in the "cashless era"

One of the issues that cannot be avoided when talking about the risks of mobile payment is personal privacy. From the first step of using mobile payment, our privacy has been exposed to risks.

On all payment platforms, whether it is Alipay or WeChat, it is necessary to bind a personal mobile phone before use to perform identity authentication and provide personal real information to each payment platform, which involves the document number, mobile phone number, hobby, address Wait.

In addition to the personal information that was actively provided during registration, in the process of using mobile payment, every consumption of our flexible board factory has traces, when it is used for meals, where to buy clothes, and what items will be played in leisure The data generated by mobile payment is recorded one by one, and there is nowhere to escape.At the same time, the rise and development of mobile payment depends on the existence of mobile Internet. The security of the Internet has been a controversial issue that has not been completely resolved since its inception.

Although various payment financial platforms set up checkpoints, payment passwords, and verification codes to ensure the security of personal accounts, network security threats such as hacker interception and virus intrusion have never been eliminated, and the dangers faced by mobile payment have never been far away.

Once these network problems penetrate into mobile payment, all the user information bound to the payment account and the funds in the account are at risk of being stolen by the criminals.

In recent years, Japan's 7pay mobile payment service has died because of its failure to ensure network security. 7pay mobile payment is a service launched by Japanese convenience chain brand 7-11. It was originally planned to serve 12 million users, but this service was frequently hacked when it was first launched, and the privacy of nearly 1,000 users was leaked. At the same time, users also suffered Loss of property.Due to the ethnic customs and the history of national development over the years, people in developed countries generally pay more attention to personal privacy. And the great risk of personal information exposure of mobile payment may make them discouraged and feel that their privacy cannot be guaranteed.At the same time, due to the mature development of the financial system and credit card payment system in developed countries, and the use of credit card payment is also very convenient, so the relatively high payment threshold credit card payment method will still be their first choice.

The lack of security in the "cashless era"

Due to the virtual nature of mobile payment and its "bundled" dependence on several parties, personal wealth is prone to security problems in the "cashless era", which makes us insecure.

First of all, unlike traditional cash transactions, the entire transaction of buyers and sellers is completed under the common sight of both parties, and the goods and money of both parties can be guaranteed. Mobile payment that does not meet this condition is likely to lead to fraud such as false transactions by both parties. behavior.

First of all, unlike traditional cash transactions, the entire transaction of buyers and sellers is completed under the common sight of both parties, and the goods and money of both parties can be guaranteed. Mobile payment that does not meet this condition is likely to lead to fraud such as false transactions by both parties. behavior.

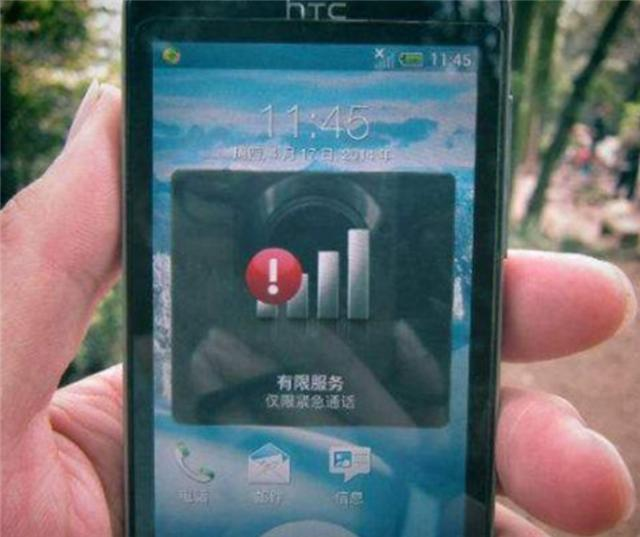

So if there is a problem in one of these areas, it will threaten the payment behavior. For example, problems such as unstable network signals or network failures, payment platform system updates or crashes, and exhaustion of mobile phone power can all cause unavailability.

These personal factors or glitches may only cause temporary inconvenience in personal life. However, in the event of a severe large-scale man-made disaster or natural disaster such as war, violent conflict, earthquake or hurricane, the signal base station, transmission fiber and terminal equipment Facilities are vulnerable to damage and destruction, and the entire society that relies on mobile payments will be paralyzed.

Therefore, the more dependent on a mobile payment society, the weaker we have control over our funds. When our money is completely controlled by the financial platform, normal life consumption is affected by many parties, and the safety of funds may fall into unpredictable dangers at any time, it is inevitable that we will feel insecure.

Humanistic care-the call of the cashless era

Although smart phone products and network services in today's society have been greatly popularized, we cannot ignore that there are still some people who do not have smart phones or have not opened online banking services, and there are still some remote areas where network coverage is not in place and mobile payment cannot be used Etc.

Some vulnerable groups, such as the elderly, may not use smartphones, online or online payments. Cash payment is the only payment method they can master. If these people pay for their daily consumption, but the merchants claim that they can only accept mobile payments, then they will not be able to obtain the materials necessary for survival, making it difficult to survive.

If at this stage, the “cashless era” is fully entered, this group of people will become “refugees” abandoned by this era. In fact, there have been many reports of conflicts arising from mobile payments in the past two years.

Not long ago, a news report reported that when an old man bought two dollars in a supermarket and settled in cash, the cashier said that he did not accept cash and forced the old man to use mobile payment, which was quite ironic. Since the old man will not use mobile payment, he has no choice but to let go of his tears on the spot.

Summary of the circuit board factory:

The development of society is inseparable from the development of advanced technology and the progress of the system, but the ultimate goal of social development is all-round development, and a good life for all people.

This requires that in social development, different quality levels of mainstream groups and special groups in social development should be distinguished, instead of neglecting the actual situation of vulnerable groups and special groups, and forcing unified development.

In order to gain a competitive advantage in the "cashless era", merchants only have the right to develop and only accept mobile payments. This will undoubtedly abandon this group of people, increase their survival pressure and burden, and will also add many hidden dangers to the society. The society of "cashless era" should not only be a society with convenient payment, but also a harmonious society full of humanistic care.

Due to the limitations of mobile payment and many hidden dangers, cash payment and mobile payment will still exist side by side in my country for a long period of time. However, with the advent of the digital age, the rapid coverage of 5G networks and smart phones, mobile payment has become the general trend, and the "cashless era" that fully covers all social groups will also come.

But while welcoming the arrival of the full "cashless era", we should not ignore the hidden dangers of mobile payment and the hidden dangers of the "cashless era". We should listen carefully and pay attention to the needs of various groups of people, so that the related supporting services and Infrastructure and so on are more standardized and improved, making mobile payment safer and more convenient. Realize the convenience of the people and benefit the people.